Profits, profits, profits!

We seek superior results in high alpha, difficult-to-trade strategies across the globe.

All rights reserved © 2026

We seek superior results in high alpha, difficult-to-trade strategies across the globe.

We seek clarity in the complex picture of the equity markets.

Our investment decisions harmonize classical security analysis and systematic techniques; fundamental depth and quant-enabled breadth; and, a combination of value and quality and momentum and sentiment.

We exploit techniques from outside the financial realm to capture below-the-surface information — revealing what’s (un)intentionally hidden.

An investment can be right and still be risky. Leaning skeptically on optimizers and heavily on insight and common sense, we choose where to diversify and what to avoid to minimize uncompensated risks.

We know transaction costs — the ultimate cost of implementing any investment strategy — are higher and more hidden than generally perceived. Controlling the “implementation shortfall” is key to holding equity-market profits.

Price-driven measures using the balance sheet, cash flow, and income statements underpin relative valuation.

Demonstrations of growth, efficiency, consistency and stability indicate the likelihood of continued operating strength.

Price momentum is the quantitative equivalent of “Don’t fight the tape.”

The actions of targeted market participants reflect and drive changes in market perspectives and prices.

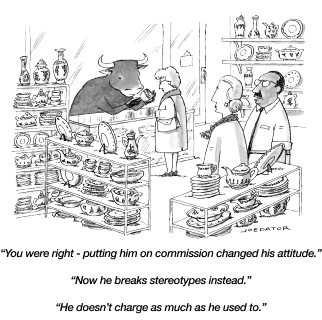

The New Yorker is the source of 99% of the cartoons we share

Enter your details below.

Enter your details below.