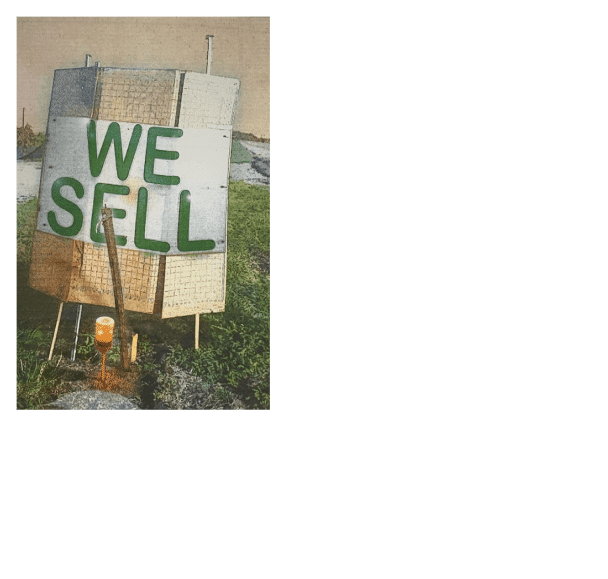

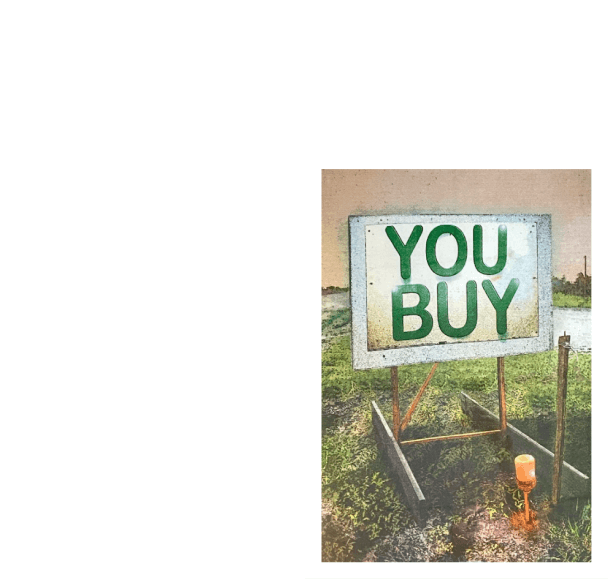

We put our money where our mouth is.

We offer client-driven mandates and client-aligned fees in a client-friendly atmosphere of transparency and candor.

All rights reserved © 2025

We offer client-driven mandates and client-aligned fees in a client-friendly atmosphere of transparency and candor.

The standard fee is the investment management fee we charge on assets under management in our flagship strategies.

The fulcrum return is the above-benchmark target for performance-based fees. It is derived by AJO Vista and based on empirical evidence, economic logic, and economic intuition. It reflects trading costs, but not investment management fees.

The fulcrum return target is NOT a guaranteed return. Actual client returns may differ materially, and clients may (gulp!) lose money.

We charge a standard flat fee of 0.8% on all assets

for our flagship strategies listed above.

We willingly set performance-based fees with symmetry around our standard flat fee and our 3.5% fulcrum return.

We aim for partnership, so we allow our clients to choose the fee calculation that meets their needs.

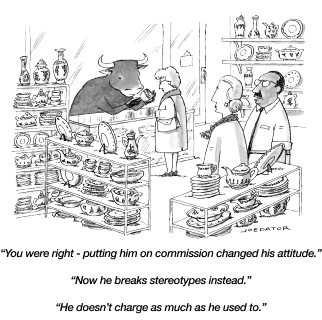

The New Yorker is the source of 99% of the cartoons we share

Enter your details below.

Enter your details below.